Chapter 4—Funding the Transportation Network

For the Boston Region MPO to be eligible to receive federal aid for transportation projects, it is required by federal law to prepare a fiscally constrained LRTP every four years to document the estimated costs and describe the regionally significant surface transportation projects and programs planned for construction or implementation for a 25-year time line. Regionally significant projects and programs are those that would increase the capacity of the transportation system, or that would cost more than $20 million.

Over the life of this LRTP, from FFY 2016 to 2040, the Boston Region MPO has the discretion to program $2.85 billion in federal funds for highway transportation projects in the region. This amount is significantly less than was available four years ago when the MPO programmed approximately $3.8 billion in Paths to a Sustainable Region.

In addition to documenting MPO discretionary spending, this LRTP reports on nearly $6 billion in planned spending on highway projects prioritized by the Commonwealth through statewide funding programs. It also documents capital resources available to the three regional transit authorities (RTAs) operating the Boston Region: the Massachusetts Bay Transportation Authority (MBTA), the MetroWest Regional Transit Authority (MWRTA), and the Cape Ann Transportation Authority (CATA).

Capital resources available to the MBTA are projected to amount to more than $10.3 billion during the life of this plan (approximately $9.1 billion in aid through the federal transit program and $1.2 billion in MBTA revenue bonds to match federal funds). Also recounted in this LRTP are the MBTA operating revenues generated from the state sales tax, assessments paid by municipalities in the MBTA’s service area, fare revenues, and other sources (discussed later in this chapter); these operating revenues are projected to reach $70.9 billion during the life of this LRTP, covering an estimated $69 billion in costs.

The MWRTA will have $51 million in federal capital resources over the life of the LRTP, and CATA will have $16 million. (Operating costs were not available at the time this LRTP was prepared.)

The financial plan outlined in this LRTP is based on federally approved projections for revenue growth over the 25 years of the plan. As this plan was being prepared, Congress had not yet passed new federal legislation that would provide long-term revenue projections. (Moving Ahead for Progress in the 21st Century, or MAP-21, is the currently active legislation that is set to expire July 31, 2015.) Therefore, for planning purposes, the federal agencies advised the MPO to assume that revenues will increase by 1.5 percent each year starting in federal fiscal year (FFY) 2021 and extending though FFY 2040. This growth factor is based on analyzing actual federal funding allocations that the region received in recent years. For the same period, project costs are anticipated to inflate by 4 percent each year.

Figure 4-1

Revenue and Growth Assumptions for LRTP Development

Source: Central Transportation Planning Staff.

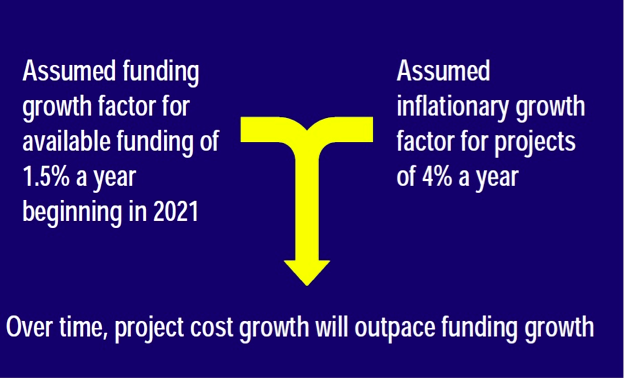

If these projections hold true, project costs will outpace available revenues, resulting in diminished buying power in future years. A project costing $10 million if constructed in FFY 2016, for example, would cost increasingly more if programmed in the outer years of the LRTP. To deliver the same project in FFY 2040, the cost would be $25.6 million, while the available revenues for that project would have increased by only $3.5 million. (See Figure 4-2 below.)

A new authorization by Congress, subsequent to the publication of this LRTP, could change the outlook for financing transportation projects in the Boston region.

Figure 4-2

Project Growth versus Funding Growth, FFYs 2016–2040

Source: Central Transportation Planning Staff.

Highway revenues programmed in the LRTP consist of federal funds approved by Congress and distributed through the Federal-Aid Highway Program and state funds approved by the Massachusetts Legislature. The various funding sources available for roadway and bridge projects in Massachusetts are outlined below.

Federal funds support construction and rehabilitation of highways and bridges on federal-aid eligible routes (as determined by the roadway’s functional classification) as well as projects and programs targeted for improvements in particular focus areas, such as improving safety or air quality, building bicycle and pedestrian networks, or interstate maintenance. Congress has established various funding programs for appropriating federal funds to these key focus areas, some of which are discussed later in this chapter.

Federal highway funds for states are typically authorized by Congress through a multi-year act. The most recent act was MAP-21, which authorized funding for FFY 2013 and 2014, and was extended through July 2015.

Congress apportions funds to the states based on formulas specified in federal law. Each year, a state may spend its apportionment only up to a ceiling or the “obligation authority,” a limit set by Congress to control federal expenditures. The obligation authority represents the federal government’s commitment to reimburse the state for eligible expenditures on approved projects.

The state must program its obligation authority before the close of the federal fiscal year, September 30, otherwise the state will forfeit the un-programmed funds and the federal government will make those funds available to other states that have the wherewithal to spend them, i.e., projects that are ready for construction. In past years, the Commonwealth has been the recipient of these so-called redistribution funds that became available when other states did not program up to their obligation authority. While the Commonwealth has benefitted from these bonuses, it also, like other states, has been subject to rescissions, when the federal government rescinded or pulled back the unused balances of previously authorized funds.

Within the obligation limits, the Federal Highway Administration (FHWA) reimburses states for costs of federal-aid eligible projects out of the Highway Trust Fund. The primary source of revenue for the Highway Trust Fund is the federal tax on motor fuels; additional revenue comes from other transportation-related fees. Recently, the Highway Trust Fund has been at risk of insolvency, in part, because its revenues are heavily dependent on the gas tax; as vehicles become more fuel efficient and vehicle miles travelled trend downward, this revenue source has become less robust.

In regions with metropolitan areas that have populations greater than 50,000, transportation projects or programs to receive federal aid must be programmed through the MPO certification process. Projects that are regionally significant, i.e., those that would add capacity to the transportation system or that cost more than $20 million, must be programmed in the LRTP, along with project descriptions and cost estimates.

Projects that are scheduled to be implemented in the near term—regardless of cost or regional impact—must be programmed in the Transportation Improvement Program (TIP), a four-year planning document that is updated annually. The TIPs from all the MPOs in a state are combined to form the State Transportation Improvement Program (STIP), which recounts the federal-aid funded projects to be implemented statewide over a four-year period.1 TIP funding levels are the basis for funding projections for the LRTP.

The TIP and STIP document the federal, state, and local shares of funding for projects and programs. Typically, federal dollars must be matched in some portion by state or local dollars, as dictated by the funding split formula of each particular federal funding program. Federal funds usually cover 80 percent of a project’s cost, and the state or local government covers 20 percent. Some federal programs offer a 90 percent federal share or full funding. Congressional earmarks in federal transportation bills often provide full funding for specific projects; however, there were no earmarks in MAP-21.

In addition to documenting federally funded projects for which the state has obligation authority, the TIP and STIP also document projects that would be funded using the Advance Construction financing method. In these cases, a state may receive approval from FHWA to begin a project before the state has received the necessary obligation authority. This pre-qualification allows a project to move forward initially with state funding, and to request federal reimbursements later.

The Massachusetts Department of Transportation (MassDOT) is the recipient of federal highway aid to the Commonwealth. After deducting the Commonwealth’s debt service payments owed to the federal government (discussed further in the Debt Service section below), MassDOT allocates the remaining federal funds to statewide road and bridge programs for projects prioritized by MassDOT, and to the MPOs in the Commonwealth for projects prioritized by these regional bodies. The funds provided to MPOs are referred to as Regional Targets.

The Regional Targets for MPOs are determined by a formula established by the Massachusetts Association of Regional Planning Agencies (MARPA), which factors in each region’s share of the state population. Of the ten MPOs and three regional planning commissions/councils in the Commonwealth, the Boston Region receives the largest portion of funding through this formula-based distribution. Because of the Boston Region MPO’s larger population, it receives nearly 43 percent of these funds for programming at its discretion. Again, these funds must be programmed in the TIP and STIP before construction can be authorized using federal-aid funds.

The Massachusetts Legislature authorizes the issuance of bonds for transportation expenditures through passage of transportation bond bills. This allows the Commonwealth to provide matching funds to federal-aid projects, to pay for fully state-funded (non-federal aid) projects, and to offer support to municipalities through local-aid programs such as Chapter 90 (discussed later in Section 2.6).

The primary source of state-aid for transportation projects in the Commonwealth is generated by the state gasoline tax, motor fuel excises, and fees from motor vehicle licensing and registration. These funds, which are deposited in the Commonwealth Transportation Fund, are used to pay debt service on bonds issued for transportation projects, and to fund MassDOT, the MBTA, and other RTAs in the Commonwealth.

These state revenues have been affected by passage of a 2014 referendum that repealed a law requiring the state gasoline tax to be automatically adjusted annually based on inflation.

The following sections provide details about highway financing in the Commonwealth.

In recent years, the Commonwealth has used a highway project financing mechanism known as grant anticipation notes (GANS) to pay for major highway projects. GANS are bonds issued by the state that are secured by anticipated, future federal highway funds.

In the late 1990s, the Commonwealth issued $1.5 billion in GANS to finance construction of a portion of the Central Artery/Ted Williams Tunnel Project. The majority of the project was completed in 2006. The Commonwealth made its final payment on this debt in 2014.

While the Central Artery/Tunnel repayments were winding down, the Commonwealth issued GANS again in 2010 for the Accelerated Bridge Program. This followed the passage in 2008 of the Accelerated Bridge Program Act, which authorized issuance of as much as $1.108 billion in GANS and $1.876 billion in special obligation bonds of the Commonwealth.

This $3 billion, eight-year program financed the design, construction, reconstruction, and repair of structurally deficient bridges across the Commonwealth. It has used novel project development and construction techniques that deliver projects on an accelerated schedule. One such project that received national attention was “Fast 14,” which replaced 14 bridges on Interstate 93 in one construction season by using prefabricated bridge deck panels.

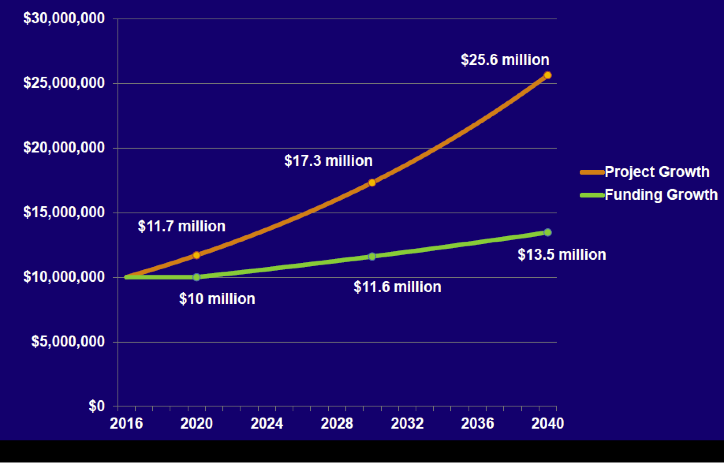

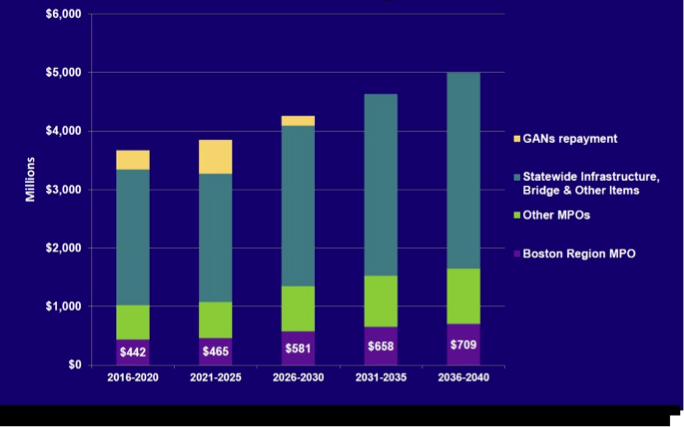

The Accelerated Bridge Program concludes in 2016, but the Commonwealth will continue to pay on the debt incurred during the next decade. The GANS for the Accelerated Bridge Program will mature between state fiscal years (SFY) 2015 and 2027. The repayment amounts, which are documented in this LRTP, are $1.108 billion for the life of the LRTP. Based on the financial projections for the LRTP, these debt payments will consume approximately 6 percent of available federal funding in FFY 2016 and increase over time to consume nearly 27% of the federal funding in FFY 2026. (See Figures 4-3 and 4-4 below.)

Figure 4-3

Federal Highway Program, FFYs 2016–2040

Source: Central Transportation Planning Staff.

Figure 4-4

Federal Highway Program, FFYs 2016–2040 by Time Band

Source: Central Transportation Planning Staff.

MassDOT is responsible for prioritizing bridge projects statewide. In addition to the Accelerated Bridge Program, bridge preservation and maintenance projects are funded through the Statewide Bridge Program.

Funds for the Statewide Bridge Program come from two federal-aid highway programs: the National Highway Performance Program (NHPP) and the Surface Transportation Program (STP). The NHPP funds bridges that are on the federal-aid system, while the STP funds bridges on public roads that are not on the federal-aid system. Projects funded through the Statewide Bridge Program typically receive 80 percent federal funding with a 20 percent non-federal match.

Approximately one-quarter of the bridges in the Commonwealth are in the Boston Region MPO area. Therefore, it is expected that MassDOT will allocate one-quarter of the amount of federal funding in the Statewide Bridge Program to the Boston Region MPO for the life of the LRTP.

Based on the financial assumptions for the LRTP, this region can expect to receive $1.16 billion in federal aid for bridge projects for the life of this LRPT. The allocation is expected to increase from $193.5 million in the FFYs 2016–20 time band to $285.6 million in the FFYs 2036–40 time band.

Additional non-federal aid for bridges and roadways is distributed to the regions based on the MARPA formula. The Boston Region MPO expects its 43 percent share, which amounts to $1.1 billion for the life of the LRTP.

MassDOT allocates funds for interstate maintenance and highway pavement resurfacing projects to the regions through its Statewide Interstate Maintenance Program and Statewide National Highway Preservation Program. The federal funding source for these programs is the NHPP.

Similar to allocation of federal-aid bridge monies, MassDOT determines the allocation of federal-aid funds for interstate maintenance and pavement management to each region of the Commonwealth based on the amount of infrastructure that must be maintained in each region.

Approximately 38 percent of the interstate lane miles in the Commonwealth are in the Boston MPO region, thus this region can expect to receive that proportion of Statewide Interstate Maintenance Funds for the life of the LRTP. As such, the Boston MPO region expects to program a total of $784.5 million in interstate maintenance projects during the life of the LRTP.

The Boston Region MPO contains nearly 32 percent of the lane miles of non-interstate highways (principal arterials) that are eligible to receive funding through the Statewide National Highway System Program. Consequently, this region can expect to receive that proportion of funding for highway preservation projects, which amounts to $341 million during the life of the LRTP.

Traditionally there has been a statewide funding category for Major Infrastructure projects that were prioritized by MassDOT for major highway modernization projects throughout the state. This funding category will be eliminated after the Interstate 91 Viaduct project in Springfield is completed. Beginning in 2017, MassDOT will no longer set aside money in the Statewide Major Infrastructure funding category, but instead will pass the funds through the MPOs for programming. (Note: This Major Infrastructure category is not to be confused with the Boston Region MPO’s Major Infrastructure investment program.)

Federal-aid highway funding for other statewide programs that address a variety of transportation needs are allocated to regions in the Commonwealth based on the MARPA formula. Again, as the most populous region of the Commonwealth, the Boston Region receives the largest share, 43%.

The statewide programs that target funding to projects that address specific needs include the Congestion Mitigation and Air Quality Improvement Program (CMAQ), Highway Safety Improvement Program (HSIP), and Transportation Alternatives Program (TAP). CMAQ supports transportation projects that reduce traffic congestion and thereby improve air quality. HSIP focuses on reducing the number and severity of crashes at locations identified as particularly hazardous based on crash reports on file at the Registry of Motor Vehicles. In addition, TAP provides grant funding for projects such as transportation enhancement, multi-use trails, and projects that create safe routes for children to access schools.

Other programs support upgrades to intelligent transportation systems and highway lighting systems, safety improvements at rail crossings, drainage improvements and storm water retrofits, and accessibility upgrades to comply with the Americans with Disabilities Act. Combined, these categories are assumed to make up 43 percent of statewide highway funding programmed in this LRTP, and amount to $2.57 billion. Table 4-1 below summarizes the funding categories presented above by five-year time bands.

Table 4-1

Projected Sources of Funds for Maintenance of Highway System in

Boston Region MPO

FFYs 2016-20 |

FFYs 2021-25 |

FFYs 2026-30 |

FFYs 2031-35 |

FFYs 2036-40 |

Total |

|

|---|---|---|---|---|---|---|

Statewide Bridge |

$193.52 |

$187.42 |

$234.20 |

$265.19 |

$285.68 |

$1166.00 |

Non-Federal Aid |

214.84 |

218.06 |

221.28 |

224.50 |

227.73 |

1106.40 |

Statewide Interstate |

132.72 |

125.61 |

156.96 |

177.74 |

191.47 |

784.50 |

Statewide National |

56.66 |

54.87 |

68.57 |

77.65 |

83.65 |

341.40 |

Statewide Infrastructure |

16.77 |

16.24 |

20.30 |

22.98 |

24.76 |

101.05 |

Remaining Statewide |

381.74 |

403.42 |

504.11 |

570.82 |

614.93 |

2475.02 |

Total |

$996.24 |

$1005.62 |

$1205.42 |

$1338.87 |

$1428.22 |

$5974.38 |

FFYs = Federal fiscal years.

Note: Dollars in millions.

Source: Massachusetts Department of Transportation.

The LRTP reflects cost estimates for all regionally significant projects in the region, including those that will receive federal-aid highway funding and those that will receive non-federal aid. As such, state funding priorities for the Boston region are reflected in this document, as well as MPO funding priorities.

The LRTP financial planning that occurs at the MPO level focuses on programming that portion of funds over which the MPO has decision-making power. As mentioned previously, MPOs are provided with Regional Targets based on funding projections, which are used for planning programming projects for the 25-year period of the LRTP. These target funds are divided among the ten MPOs and three regional planning commissions/councils in the Commonwealth based on the MARPA formula, with the Boston Region MPO receiving a 43-percent share. While the MPOs have discretion over this funding, some restrictions apply. For example, the MPOs must, program a particular portion of their target funds for projects and programs that meet the requirements of the CMAQ, HSIP and TAP programs.

During the life of this LRTP, from FFY 2016 to 2040, the Boston Region MPO expects to program approximately $2.85 billion in federal funds for highway transportation projects in the region. This amount is significantly less than was available four years ago, when the MPO programmed approximately $3.8 billion in Paths to a Sustainable Region. (See Table 4-2 below for a comparison by time band.)

In the near term, from FFY 2016 to 2019, the Boston Region MPO will have the discretion to program between $75 million and $92 million a year. Each year approximately $13 million will be targeted to CMAQ projects, approximately $4 million to HSIP projects, and an average of $3.5 million to TAP projects.

Table 4-2

Comparison of Available Capital Highway Funds in Charting Progress to 2040 to the Latest LRTP, Paths to a Sustainable Region

FFYs 2016-20 |

FFYs 2021-25 |

FFYs 2026-30 |

FFYs 2031-35 |

FFYs 2036-40 |

|

|---|---|---|---|---|---|

Paths to a Sustainable |

$557.47 |

$815.61 |

$1018.44 |

$1180.65 |

-- |

Charting Progress to 2040 |

441.65 |

464.87 |

580.90 |

657.78 |

$708.60 |

Difference |

($115.82) |

($350.74) |

($437.54) |

($522.87) |

$708.60 |

Percentage Change |

-21% |

-43% |

-43% |

-44% |

-- |

FFYS = Federal fiscal years.

Note: Dollars in millions.

Source: Central Transportation Planning Staff.

The Commonwealth’s Chapter 90 program reimburses municipalities for local roadway and bridge projects. Municipalities have the discretion to select these projects, which may include maintenance of municipal roadways, sidewalk improvements, right-of-way acquisition, landscaping, drainage improvements, street lighting, and upgrades to traffic control devices. Chapter 90 funding for SFY 2016 is expected to total $300 million, and, $200 million per year thereafter.

The LRTP reports federal funding programmed for the three regional transit authorities (RTAs) that operate primarily within the Boston Region MPO’s planning area: the MBTA, MWRTA, and CATA. Transit funds programmed in the LRTP consist of funds distributed through the Federal Transit Administration’s (FTA’s) formula funding program as well as other federal grants and non-federal aid, including revenue bonds that match federal funds. These funding sources are described in further detail in this chapter.

Long-range revenue projections for the MBTA that are reflected in this LRTP are based on a federally approved systemwide finance plan prepared when the Commonwealth successfully pursued a federal New Starts grant for the Green Line Extension project in Somerville and Medford. The Green Line Extension Finance Plan includes revenue projections through SFY 2035; for the purposes of planning for the LRTP; those projections have been extended to SFY 2040. The bond-issuing strategy associated with the Green Line Extension Finance Plan assumes that the MBTA will issue bonds only to match its federal formula funds. However, this level of bond issuance falls far short of the MBTA’s identified needs. The backlog of MBTA projects needed to keep the transit system in a state-of-good-repair is estimated to be $6.5 billion during the next several decades.

Over the life of this LRTP, capital resources available to the MBTA are projected to be more than $10.3 billion for the life of this plan (approximately $9.1 billion in federal aid and $1.2 billion in MBTA revenue bonds to match federal funds). Also reported in this LRTP are MBTA operating revenues generated from the state sales tax, assessments paid by municipalities in the MBTA’s service area, fare revenues, and other sources (discussed later in this chapter); these operating revenues are projected to total $70.9 billion for the life of this LRTP, covering an estimated $69 billion in costs.

The MWRTA will have $51 million in federal capital resources for the life of the LRTP, and CATA will have $16 million. (Operating revenues were not available at the time this LRTP was prepared.) A detailed discussion of the RTAs’ capital and operations programs is provided below.

The capital maintenance needs of the MBTA include infrastructure projects, such as signal and track upgrades; fleet overhauls and replacements; system enhancement projects; and accessibility projects, such as improvements necessary for complying with the Americans with Disabilities Act (ADA). These improvements are funded through the MBTA’s capital program, which is primarily funded by two major sources: federal grants and revenue bonds; other sources include project financing and state appropriations. (Details about short-term capital financing are available in the MBTA’s Capital Investment Program.)

Over time, it is assumed that the capital maintenance needs of the MBTA will consume almost 100 percent of all MBTA capital revenues (excluding those from any special state appropriations) and that the majority of revenues available during the period of this LRTP will be used to maintain the system in a state-of-good-repair. More detail, however, will be available as the MBTA moves forward with its long-range planning, which will be documented in its Program for Mass Transportation, and in it short-range plan the CIP.

As noted above, total proceeds from all MBTA capital program funding sources from SFY 2016 through SFY 2040 are estimated to be nearly $10.3 billion. Included in this figure are funds from the FTA formula program and federal grants as well as revenue bonds that the MBTA would issue to pay the local share of its capital projects. (See Table 4–3 below.)

Table 4-3

MBTA Capital Finances by Five-Year Time Band

SFYs 2016-20 |

SFYs 2021-25 |

SFYs 2026-30 |

SFYs 2031-35 |

SFYs 2036-40 |

Total |

|

|---|---|---|---|---|---|---|

Section 5307 |

$732.95 |

$789.60 |

$850.62 |

$916.36 |

$987.18 |

$4276.71 |

Section 5337 |

628.91 |

677.52 |

729.88 |

786.29 |

847.06 |

3669.66 |

Section 5339 |

29.98 |

32.30 |

34.79 |

37.48 |

40.38 |

174.93 |

New Starts, Small Starts, |

732.45 |

296.00 |

-- |

-- |

-- |

1028.45 |

MBTA Revenue Bonds |

282.05 |

288.23 |

302.93 |

318.39 |

-- |

1191.60 |

Total |

$2406.35 |

$2083.65 |

$1918.23 |

$2058.52 |

$1874.62 |

$10341.36 |

MBTA = Massachusetts Bay Transportation Authority. SFYs = State fiscal years.

Note: Dollars in millions.

Source: Massachusetts Bay Transpiration Authority.

Compared to the funding assumptions reported in the last LRTP, Paths to a Sustainable Region, there is a trend toward declining funding levels over each five-year time band of this LRTP. Whereas in the FYs 2016–20 time band there is nearly level funding compared to the previous LRTP, in the outer time band of FYs 2031–35, revenues will be reduced by 21 percent. (Comparisons for the FY 2036–40 time band are not available since Paths to a Sustainable Region included projections only to FFY 2035.)

This trend reflects an assumption that federal funding levels are declining. As this LRTP was being prepared, Congress had not yet passed new federal legislation that would provide long-term revenue projections. For planning purposes, the federal agencies advised the MPO to assume that revenues will increase by only 1.5% each year starting in FFY 2021 and extending though FFY 2040.

Table 4-4

Comparison of Available Capital Transit Funds in Charting Progress to 2040 to the Latest LRTP, Paths to a Sustainable Region

FFYs 2016-20 |

FFYs 2021-25 |

FFYs 2026-30 |

FFYs 2031-35 |

FFYs 2036-40 |

|

|---|---|---|---|---|---|

Paths to a Sustainable Region |

$1410.00 |

$1635.00 |

$1895.00 |

$2197.00 |

-- |

Charting Progress to 2040 |

1391.85 |

1499.42 |

1615.30 |

1740.13 |

$1874.62 |

Difference |

($18.15) |

($135.58) |

($279.70) |

($456.87) |

1874.62 |

Percentage Change |

-1% |

-8% |

-15% |

-21% |

-- |

Note: Dollars in millions.

Source: Central Transportation Planning Staff.

As mentioned previously, the funding assumptions for this LRTP and the associated bond issuance appears insufficient to meet the MBTA’s state-of-good-repair needs. During the life of the LRTP, the MBTA estimates that it would need an additional $6.5 billion for the next several decades. As this LRTP was being prepared, however, specific projections were not available. In addition, future state commitments to MBTA capital projects for the life of this LRTP were not determined.

In the future, the MBTA intends to use pay-as-you-go financing to fund its capital program over the long term. Pay-as-you-go is a financial instrument that uses cash to fund capital projects rather than issuing bonds and incurring debt-service expenses. While the MBTA’s goal is to utilize this tool, it is not reflected in this LRTP.

Capital funding projections for MWRTA and CATA are depicted in Table 4-5 and 4-6 below. The MWRTA and CATA can expect $51 million and $16 million, respectively, in federal Section 5307 funding for the life of this LRTP.

Table 4-5

MWRTA Capital Finances by Five-Year Time Band

Funding Source |

SFYs 2016-20 |

SFYs 2021-25 |

SFYs 2026-30 |

SFYs 2031-35 |

SFYs 2036-40 |

Total |

|---|---|---|---|---|---|---|

Section 5307 |

$7.46 |

$9.81 |

$10.56 |

$11.38 |

$12.26 |

$51.47 |

Section 5337 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

Section 5339 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

Total |

$7.46 |

$9.81 |

$10.56 |

$11.38 |

$12.26 |

$51.47 |

MWRTA = MetroWest Regional Transit Authority. SFYs = State fiscal years.

Note: Dollars in millions.

Source: Massachusetts Department of Transportation.

Table 4-6

CATA Capital Finances by Five-Year Time Band

Funding Source |

SFYs 2016-20 |

SFYs 2021-25 |

SFYs 2026-30 |

SFYs 2031-35 |

SFYs 2036-40 |

Total |

|---|---|---|---|---|---|---|

Section 5307 |

$2.77 |

$2.99 |

$3.22 |

$3.47 |

$3.73 |

$16.18 |

Section 5337 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

Section 5339 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

Total |

$2.77 |

$2.99 |

$3.22 |

$3.47 |

$3.73 |

$16.18 |

CATA = Cape Ann Transportation Authority. SFYs = State fiscal years.

Note: Dollars in millions.

Source: Massachusetts Department of Transportation.

Below is a detailed discussion of the federal funding sources available for the RTAs’ capital programs.

Federal aid for transit programs has been authorized by Congress through MAP-21. By this authorization, FTA operates its formula funding programs, which allocate funding to states based on demographic data from the US census for each state’s urbanized area (UZA). (A UZA is an area defined by the US Census Bureau with a population of 50,000 or more.) For UZAs with populations of more than 200,000, such as the Boston UZA, the allocations also take into account transit service data reported by recipients of the federal funds. The source of this formula funding as of FY 2015 is the Mass Transit Account of the Highway Trust Fund.

MassDOT is the recipient of this federal aid in the Boston UZA area. MassDOT sub allocates these funds to RTAs based on a negotiated split agreement. The Boston Region MPO programs the formula funds in its TIP and LRTP for the MBTA, MWRTA, and CATA.

The FTA requires a 20 percent non-federal match to the 80 percent federal share of formula grants. In the case of the MBTA, the matching funds are generally revenue bonds. The other RTAs may use funds from the state’s RTA Capital Assistance Program or toll credits for the match.

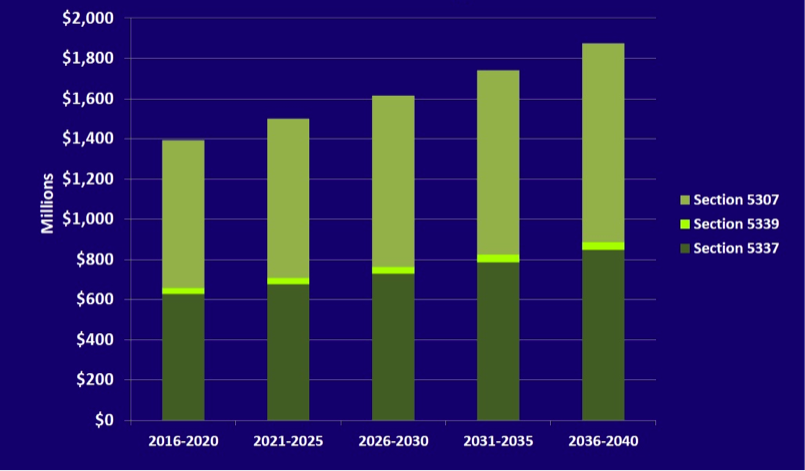

Formula funding reflected in the TIP and LRTP includes funding from FTA program Sections 5307, 5337, and 5339. (See Figure 4-5 below for the MBTA allocation.) Section 5307 is the Urbanized Area Formula Program, which funds capital, planning, job access and reverse-commute projects, and operating assistance for transit agencies. Section 5337, the State-of-Good-Repair Program, supports the maintenance, rehabilitation, and replacement of transit assets to maintain a state of good repair. Eligible assets include rail, trolley ferries, bus rapid transit, and bus services operating on high-occupancy-vehicle (HOV) facilities. Section 5339, the Bus and Bus Facilities Formula Grants Program, provides funding to replace, rehabilitate, and purchase buses and related equipment as well as construct bus-related facilities.

Figure 4-5

MBTA Federal Transit Programs, FFYs 2016–2040 by Time Band

Source: Central Transportation Planning Staff.

The LRTP also programs federal grants that are provided to this region through non-formula based or competitive programs. A major award came to the Boston Region in early 2015, for example, when the FTA approved $996 million in New Starts funding (through Section 5309, the Fixed Guideway Capital Investment Grant Program) for construction of a light rail extension in the cities of Somerville and Medford. The Green Line Extension project has a multi-year federal commitment that will pay for nearly half the costs of the extension of the line to College Avenue in Medford. More than half of the project will be funded by the Commonwealth. Construction and operating funds for the Green Line Extension project are reflected in the finances of this LRTP.

Other significant grants were awarded following Hurricane Sandy, when the MBTA received monies from the FTA’s Public Transportation Emergency Relief Program to make transit infrastructure more resilient to natural disasters. One $21.67-million grant supported the Green Line Fenway Portal Flood Proofing project, which would erect flood barriers at subway portals in a flood-prone area of Boston. Another $13.39-million grant funded the Charlestown Seawall Replacement project, which would protect a bus maintenance facility in Boston from the adjacent Mystic River flooding. In addition, the MBTA receives funding from the Department of Homeland Security, for security measures.

Other significant state funding is enabled through the Commonwealth’s transportation finance legislation. Recent legislation has provided for a $6-billion investment in the MBTA’s transit system over a ten-year period. This investment focuses on projects that will keep the system in a state of good repair and those that will help economic expansion in the Commonwealth. These projects include procurement of Red, Orange, and Green Line vehicles and buses, energy conservation projects, upgrades to transit power and signal systems, the state-funded portion of the Green Line Extension project, and the design of the South Coast Rail commuter rail extension project.

Some state-funded transit improvements are occurring through the State Implementation Plan (SIP), which includes a group of transit projects that are legal commitments of the Commonwealth as they are agreed-upon air-quality mitigation measures associated with the Central Artery/Tunnel project. Ongoing SIP projects include the Green Line Extension (to Union Square and Medford Hillside) and improvements to the Fairmount commuter rail line in Boston.

Other state funds are made available through the state’s RTA Capital Assistance Program.

In 2000, the Massachusetts Legislature updated the MBTA’s enabling legislation. This update, commonly referred to as Forward Funding, established the current financing structure of the MBTA, which provided 5 percent of the state sales tax as a dedicated revenue stream for the MBTA and expanded the service area to 175 municipalities for the purpose of local annual assessments. Revenues from these sources are used primarily to fund operations and maintenance costs for the MBTA, but also are used to secure revenue bonds that the MBTA uses to match federal funds for capital project. Other sources of MBTA operating funds include, transit fare revenues, non-fare sources, state contract assistance, state appropriations, and federal operating assistance.

Over the life of this LRTP, revenues for operations and maintenance are projected to be $70.9 billion, while costs are projected at $69 billion. The revenue projections account for proceeds from the sales tax, local assessments, fares, and other non-fare revenues. It also accounts for state operating assistance for the Green Line Extension and the South Coast Rail commuter rail extension (which has yet to be constructed), and projects and service-related initiatives implemented as mitigation for delays in constructing the Green Line Extension.

The costs include more than $60 billion in operating and maintenance costs and $8.8 billion in debt-service payments. During the life of this LRTP, the MBTA’s debt-service payments will account for nearly 13 percent of the MBTA’s total operating expenses. The MBTA’s debt service is discussed later in this chapter.

Table 4–7

MBTA Revenues and Costs by Five-Year Time Band

SFYs 2016-20 |

SFYs 2021-25 |

SFYs 2026-30 |

SFYs 2031-35 |

SFYs 2036-40 |

Total |

|

|---|---|---|---|---|---|---|

Operating Revenues: |

|

|

|

|

|

|

Sales Tax and Local |

$5,904 |

$6,373 |

$6,925 |

$7,558 |

$8,263 |

$35,023 |

Fare Revenue |

3,156 |

3,484 |

3,972 |

4,666 |

5,227 |

$20,505 |

Non-Fare Revenue** |

1,999 |

2,685 |

3,095 |

3,514 |

4,000 |

$15,293 |

Federal Funds |

32 |

20 |

20 |

20 |

20 |

$112 |

Total Operating Revenues |

$11,091 |

$12,562 |

$14,012 |

$15,758 |

$17,510 |

$70,933 |

Operating Costs: |

|

|

|

|

|

|

Operating Costs |

$8,616 |

$10,213 |

$11,875 |

$13,730 |

$15,927 |

$60,361 |

Debt Service |

2,401 |

2,117 |

1,704 |

1,467 |

1,133 |

$8,822 |

Total Operating Costs |

$11,017 |

$12,330 |

$13,579 |

$15,197 |

$17,060 |

$69,183 |

* includes sales tax and assessments. ** includes GLX Mitigation, State Operating Assistance for GLX and South Coast Rail, and additional state contract assistance

GLS = Green Line Extension Project. SFYs = State fiscal years.

Note: Dollars in millions.

Source: Massachusetts Bay Transpiration Authority.

Below is a summary of the various funding sources for the MBTA’s operations and maintenance.

The dedicated revenues from state sales tax are equal to whichever is greater: the amount of actual sales tax receipts generated from 20 percent of the statewide sales tax, or a base revenue amount. The annual amount of dedicated sales tax revenues the MBTA receives is subject to annual upward adjustment based on comparing the percentage increase of inflation to the increase in actual sales tax receipts, to a maximum 3 percent increase, and in no event to be less than the amount the MBTA received in the previous year.

Legislation enacted in 2014 (Chapter 359 of the Acts of 2014, amending Chapter 10, Section 35T) increased the base revenue amount in SFY 2015 to $970.6 million, and increased the dedicated sales tax revenue amount to MBTA by an additional $160 million annually. Since the inception of Forward Funding, the base revenue amount has been greater than the amount of actual sales tax receipts generated from 20 percent of the statewide sales tax.

During the period SFY 2016 to SFY 2040, sales tax revenue is assumed to increase at an average of approximately 2 percent per year. Therefore, the projected sales tax revenue the MBTA expects to receive for the life of this LRTP equals approximately $29.7 billion.

The MBTA also receives funding through local assessments in accordance with a statutory formula. The 175 municipalities within the MBTA’s service district pay an assessment to the MBTA on an annual basis. The amount paid by each municipality varies according to the population and the level of service provided.

Proceeds from local assessments were $160 million in SFY 2015. Local assessments are assumed to increase 2 percent each year through SFY 2040. During the life of this LRTP, projected local assessment revenue equals approximately $5.3 billion.

Fare revenue projections from the existing system were $598 million in SFY 2015 and are projected to increase by an average of 3 percent per year to yield $20.5 billion for the life of the LRTP.

Current legislation sets fare increases at no more than 5 percent every other year with the next one set for SFY 2017. No additional fare increases are assumed in this LRTP.

The MBTA derives its non-fare revenue from a variety of sources, including parking fees, advertising, concessions, rent, interest income, utility reimbursements, and non-operating revenues, such as income earned on investments and sale of property.

Non-fare revenue figures reflected in this LRTP include those items as well as revenues from implementing projects and service-related initiatives that mitigate for delays in the operation of the Green Line Extension, state operating assistance for the Green Line Extension and South Coast Rail projects, and additional state contract assistance.

The non-fare revenue in SFY 2015 was $214 million. During the life of this LRTP, projected non-fare revenue equals approximately $15.2 billion.

Federal operating assistance is received from the FTA Section 5307 Preventative Maintenance funding. The federal operating assistance revenue in SFY 2015 was $12 million. The level of funding from Section 5307 is presumed to decline during the life of this LRTP, from $ 12 million in SFY 2016 to $8 million in SFY 2017 to $4 million each year thereafter. For the life of this LRTP, projected federal operating assistance equals approximately $112 million.

The MBTA’s operating expenses include wages, benefits, payroll taxes, materials, supplies, services, and purchased transportation. Operating expenses for SFY 2015 were $1.5 billion. The Green Line Extension Finance Plan also assumes a variable average annual increase in operating costs of 3-to-4 percent, averaging 3 percent from SFY 2016 to SFY 2040. This percentage is based on trend line analysis of known anticipated needs and past operating costs.

Total operating expenses during the life of the LRTP are estimated to be $69 billion. This cost includes more than $60 billion in operating and maintenance costs and $8.8 billion in debt-service payments. Costs are projected to increase during the life of the LRTP from $8.6 billion in SFY 2016–20 time band to nearly $16 billion in the outer SFY 2036–40 time band. Meanwhile, debt service payments are scheduled to decline during the life of the LRTP, from a high of $2.4 billion in the SFY 2016–20 time band to $1.1 billion in the outer SFY 2036–40 time band.

MBTA bonds were previously backed by the Commonwealth prior to enactment of the Forward Funding legislation. Upon the effective date of the Forward Funding legislation, however, contract payments from the state ceased, and all outstanding debt became the MBTA’s responsibility. The $8.8 billion figure cited here represents both current and prior-obligation debt.

(See Table 4–7 above for operating revenues and costs by five-year time band.)

1 The Boston Region MPO is considering producing a five-year TIP.